I will go through some of the myths spread and discuss why they are demonstrably myths, not reality.

MYTH: There were no victims in Zeek until SEC got involved.

FACT: A victim that doesn't know s/he is a victim, is nonetheless a victim.

This myth has been repeated by various Zeekheads who are apparently still in denial, a month after this Ponzi had been shut down WITH cooperation from the scam leader, Paul R. Burks. Many claimed that affiliates were happy until SEC came along.

One can be victimized by things s/he does not even know about. Second hand smoke is a great example. People inhaling second-hand smoke are victims, even though they may be too young to understand it. Ignorance of the victim status is just ignorance. It is NOT bliss. Blaming SEC would be a lot like Neo blaming Morpheus for showing him "the truth".

Living in a dream, with people watching their "VIP Points" growing, is not real. People who prefer living in a dream world won't make it in real life.

MYTH: Zeek is not a Ponzi because they can just lower the RPP.

FACT: Zeek's RPP is completely fictional. It is 100x higher than it "should be" if it really works as they described".

This theory was advanced by Len Clements of Market Wave. He has a history of helping MLMs write comp plans, and I respect his expertise in MLM related matters. He wrote a long analysis of ZeekRewards. It was so long, it wasn't released until a day AFTER Zeek was shut down. It is an excellent piece of research and analysis... EXCEPT the section where he claimed Zeek's not a Ponzi because they can just "lower the RPP" share. Let me explain why.

In the SEC complaint, it stated that Zeek took in 172 million in July 2012, but paid out 170 million. Of that 172 million, only 2% did not come from affiliates. In the SEC complaint, this is what #5 said:

5. Approximately 98% of ZeekRewards’ total revenues, and

correspondingly the purported share of “net profits” paid to current investors, are

comprised of funds received from new investors. (See end for link)

In other words, only 2% (or less) of the Zeek total revenue is from "auctions" (or store, or whatever), which is the REAL profit. 50% of that is 1%, or 1.72 million. That is the number they *should* be paying out, if they really operate at their own explanation: 50% of auction revenue.

But they don't. They paid out 100 TIMES MORE THAN THEY SAID THEY SHOULD.

Or calculate it another way: what is the REAL daily profit share, if we use 1.72 million a month? That's only 56000 a day. They have 3 BILLION "VIP Points". That's about 0.00187% a day, or 0.056% a month. Even money market accounts pay more than that!

In reality, Zeek pays somewhere between 0.8% to 1.9% a day. They don't operate the way they claimed. It's a fraudulent operation. It's a scam. If they want to be legal, NOBODY would be putting any money in.

MYTH: Zeek rewards is not an investment! Affiliates don't invest money, they buy bids!

FACT: Zeek Rewards passes the Howey Test. Therefore it is an investment. It has ALWAYS BEEN an investment.

A lot of Zeekheads in denial (or shills) still insist that Zeek's not an investment, because affiliates buy bids. Indeed, this was the official line as of August 2011. In a blog post titled "Zeek Has Done LOST His Mind!" "admin" (probably Alex deBrantes, Dawn's fiancee and Zeek's community manager) posted that:

These last changes and enhancements are regarding our Retail Profit Pool, how points/shares are earned in that pool and the amount of bids currently held in each affiliates inventory. The issues we needed to address and the solutions we came up with are as follows:

1. Earning “shares” in a profit-share pool based on how much an affiliate has PURCHASED is considered a passive investment. We cannot give points or shares in that pool based on purchases any longer.and later

Points for new bid purchases that have not already earned points in the RPP are as follows:And finally...

- For each bid you give away to a personally sponsored Zeekler.com customer a full point per bid will be added to your RPP balance..

All Zeekler.com bids given away as samples have an expiration date of 30 days after date of transfer.

In other words:

It used to be that when you buy bids, and share in the profit. We decided that's too much like an investment, so we changed the terminology. We'll let you buy bids, "give away" those bids, and share in the profit.It's the exact same thing, with an extra step in the middle. However, if you add in the last part... about the bids given away expires in 30 days...

It doesn't matter if you give the bids to a real customer or your cat. As long as you give them away, you get share of the profit. It's better if nobody use those bids any way, more profit for all of us!In other words, the change was purely cosmetic facade.

Furthermore, the official definition of an investment was defined by the SEC over 50 years ago called the Howey Test. Zeek passes all four criteria of the test. It is indeed an investment.

MYTH: We don't guarantee a return! We're not a Ponzi!

FACT: The two are unrelated.

This is another one of the myths repeated by Zeekheads, who enjoy repeating the company propaganda. As explained above, Zeek is an investment, and investment merely requires "expectation of return", not guaranteed return. Thus, not guaranteeing a return has nothing to do with being a Ponzi or investment.

MYTH: Zeek's got all these compliance consultants and lawyers! It must be legal!

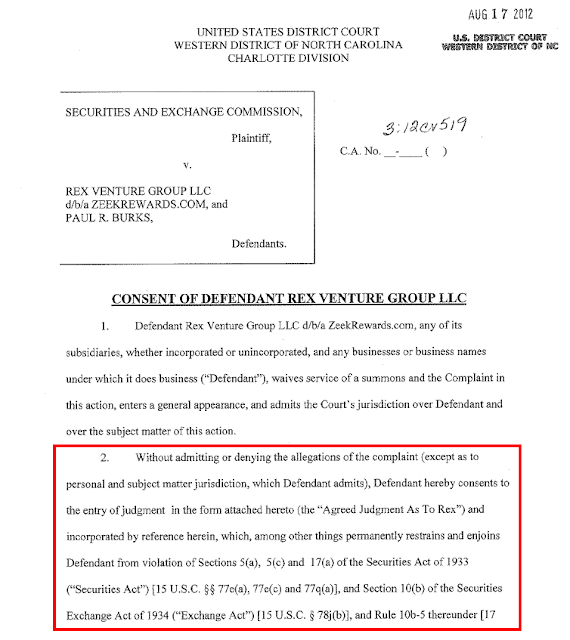

FACT: Paul Burks "no contest" plea means it's NOT legal, and he admitted it.

Here's a consent he signed, co-signed by his lawyer, AND notarized by witness.

You can see the link to PDF file at the end.

Hiring a lawyer does NOT ensure compliance. ACTUAL CHANGES in business model does.

MYTH: SEC just surprised Paul Burks one day, and shut the whole thing down in blink of an eye!

FACT: SEC lawyers had been in contact with Burks and his attorney for a period of time (unknown duration, may even be several weeks) before the shutdown on August 17th, 2012.

This narrative was spread by various Zeek defenders, notably Dave Kettner and Robert Craddock (and presumably backed by Todd Disner).

To disprove this myth is simple. The following is a motion filed by Burks' attorney, Noell P. Tin

2. On August 17, 2012, following a period of cooperation between Mr. Burks and Rex Ventures Group, LLC, and the SEC—cooperation that included the production of hundreds of thousands of documents, including financial records, e-mails, and all manner of electronic files—the defendants entered into a consent agreement with the SEC.

That's right, "following period of cooperation" where "hundreds of thousands of documents" were turned over.

Add to that cancellation of Red Carpet Event (scheduled one week after the shutdown), as well as cancellation of various conference calls leading up to the shutdown, indicates that Zeek knew exactly what was coming on August 17th 2012. They knew they were under investigation, and they did NOT let any one know until SEC actually closed their doors and changed the locks.

MYTH: Paul Burks was not adequately represented by his attorney!

FACT: Noell P. Tin is one of the best attorneys in North Carolina, both criminal and civil trials, and specialized in white collar crime defense.

This narrative was also spread by Kettner and Craddock, who claimed to have overheard the conversation in Burks office. This was picked up by various "supporters" who then repeated the narrative, such as this one:

Burks' lawyer is Noell P. Tin, one of the best white-collar crime defense lawyers in North Carolina (or even in the nation). In fact, he had a reputation of taking on clients of white collar crimes, such as Ponzi scheme ringleaders. Don't believe me? Would you believe newspaper reports?

Here's one where he defended Charis Johnson, leader of 12DailyPro, a predecessor of Ad Surf Daily Ponzi, and by extension, an ancestor of Zeek Rewards Ponzi.

How about another one where he defended Harrison, who got a bunch of seniors into a Ponzi scheme.

Mr. Tin is actually a VERY good lawyer. He got a man freed after 11 years in prison, and another guy off a drug charge after proving his client was coerced into it... if you ever bothered to check his legal biography. He had plenty of other cases, but those are the biggest ones.

References

SEC Complaint against Zeek Reward

https://docs.google.com/viewer?a=v&pid=sites&srcid=ZGVmYXVsdGRvbWFpbnxhc2R1cGRhdGVzZmlsZXN8Z3g6NWE1YWI3MWU2OTg3OTJkZQ

Rex Venture Group consent to judgement, as signed by Paul Burks and his lawyer

https://docs.google.com/viewer?a=v&pid=sites&srcid=ZGVmYXVsdGRvbWFpbnxhc2R1cGRhdGVzZmlsZXN8Z3g6NjA1OWY2YThiZDdjZDM0Yg

Burks' Response to motion by receiver

https://docs.google.com/viewer?a=v&pid=sites&srcid=ZGVmYXVsdGRvbWFpbnxhc2R1cGRhdGVzZmlsZXN8Z3g6NzQ3MjkzZDMzODVkNzhmMA

No comments:

Post a Comment