Slightly old news, but on February 7th, 2013 Judge Mullen, who is presiding over the Zeek Rewards ponzi case, rejected request by certain parties to appoint their lawyer as an "examiner" to fight the receiver's investigation.

http://www.ponzitracker.com/main/2013/2/7/zeek-judge-denies-request-for-appointment-of-examiner-has-ut.html

Saturday, February 16, 2013

Friday, February 15, 2013

Did DSA "throw FHTM under the bus", so to speak?

| DSA (US) Logo (Photo credit: Wikipedia) |

- FHTM is NOT a member of DSA (supposedly they applied for 3 years, denied 3 years, and decided not to try again in 2011)

- DSA knew something's wrong with FHTM which is why they never were admitted. There were several requests for changes from the DSA, but FHTM never did them.

Some industry members were not happy. Kevin Thompson, of Thompson and Burton, i.e. "The MLM Attorney", essentially concluded that because FHTM is not a part of DSA, DSA basically "rolled them under the bus".

The question that needs to be answered are:

- Is DSA only answerable to its members?

- Should DSA be speaking out against scams BEFORE they become popular?

Thursday, February 14, 2013

Affinity Scam Hits... Alcoholics Anonymous?

According to New Haven Register (newspaper), a local Alcoholics Anonymous (AA) chapter was embroiled in controversy when one of the AA leaders started recruiting the fellow AA members for a cash gifting scheme (which is just a fancy name for pyramid scheme).

http://www.patrickpretty.com/2013/02/09/new-haven-register-witness-says-alcoholics-anonymous-members-were-recruited-for-cash-gifting-scheme-and-that-largest-conflict-ive-ever-seen-in-aa-ensued/

http://www.patrickpretty.com/2013/02/09/new-haven-register-witness-says-alcoholics-anonymous-members-were-recruited-for-cash-gifting-scheme-and-that-largest-conflict-ive-ever-seen-in-aa-ensued/

This blog has previously covered many types of affinity fraud, and many suspect schemes perpetuate within a certain community. Herbalife appears to be very popular in Latino / Hispanic communities, for example. Other affinity groups vulnerable to scams would include the gay community, churches, alumni associations, and more.

Wednesday, February 13, 2013

MLMers, beware the IKEA effect

|

| An IKEA Store along Alexandra Road in Queenstown, Singapore. (Photo credit: Wikipedia) |

For those who don't know what IKEA is, IKEA is a Swedish furniture maker where you buy it unassembled, and usually of merely adequate quality, so it's cheap, and you need to assemble it yourself. From build-a-bear to custom-built PCs to DIY kits to cake mixes to orange concentrates to IKEA and other You-Assemble furniture, the IKEA effect is everywhere, when you love the stuff you "built" even when it's crap. It leads to exaggerated sense of self-worth.

When Duncan Hines and other food makers introduced instant cake mixes in the 1960's (where you just mix and put in a pan to bake), housewives HATED it, as they don't feel involved in the process. The makers responded by removing some ingredients so the preparer must add eggs to the mix. Housewives loved it. Now they feel involved in the baking process.

Dan Ariely (whom have been quoted many times in this blog), cited the IKEA effect as far back as 2009, though the most popular citing is a paper in Harvard Business Review in 2011.

Such an effect is further exacerbated when people, not wanting to embarrass you, decided not to tell you the whole truth (such as what you made is junk).

MLM is notorious in exploiting this cognitive bias.

Tuesday, February 12, 2013

Affinity Fraud Runs in ALL Communities

|

| English: Florida Division of Insurance Fraud Badge (Photo credit: Wikipedia) |

Common characteristic could be location, religion, race, interest, hobby... even sexual orientation.

From 2005 to 2012, Mr. Elia defrauded dozens of people in Florida's gay community out of millions by claiming to have a special investment program that yields up to 26% APR, and quarterly yields up to 20%. Then he hid the assets by transferring money to entities he controlled.

Monday, February 11, 2013

The Crazy Conspiracy of Persecution

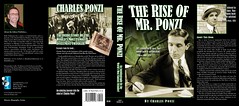

| Charles Ponzi's autobiography (Photo credit: MarkGregory007) |

Back in 2010, FDA shut down the makers of "Miracle Mineral Supplement", called Project Greenlife. PGL sold this mineral solution that you are supposed to add citric acid to the solution and drink it, which supposedly will cure variety of ailments. However, actual scientific tests show what this actually produce is primary ingredient in industrial bleach (yuck!)

Instead of stopping as requested, the people behind PGL decided to make more of this MMS in a backyard, and continue to sell the stuff online.

Department of Justice just charged the four people involved with conspiracy, transporting misbranded drugs, and more.

The four went to a "Pro Advocate Group", some group that claims to offer legal advice, but instead, offer legal mumble-jumbo instead. PAG mail random documents with the court claiming to have reached an "understanding" if the court doesn't reply in X days.

What's interesting is PAG tactics are very similar to the various "sovereign citizen" groups who enjoys filing bogus liens and documents. What's even MORE interesting is PAG was previously engaged by none less than Ad View Global, a Ponzi scheme that's linked to Andy Bowdoin of "Ad Surf Daily" ponzi scheme.

Sunday, February 10, 2013

Money Mindsets that MLM Exploits to Your Ruin

| Finance (Photo credit: Tax Credits) |

Why is this important, because these mindsets increases your risk of falling for a scam.

Some of the relevant "sins" are...

- Anorexic Spending -- inability to spend money on the *real* necessities, like critical health care, proper food, shelter, and clothing

Instead, the money was spent on unproven nutritional supplements, fancy "diets", fancy car, big house, fancy cloths... and so on, often just to keep up appearances of luxury. MLM and "lifestyle" coaches often advise people to "fake it till you make it", that acting rich will lead you to being rich. What it does is lead you further into debt.

- Financial Enabling -- giving money to someone who you thought needed it. You may be be generous, but you just basically let that person avoided the problem... "until next time"

This is more about the people around the victim... If the "victim" needs money, giving him or her money doesn't solve her problem. As the Jesus had said, give the man a fish, and he eats for a day. Teach the man how to fish, and he eats for a lifetime. Giving money to people who need money is the same thing... you simply delayed his or her problem for a while longer.

Subscribe to:

Comments (Atom)