|

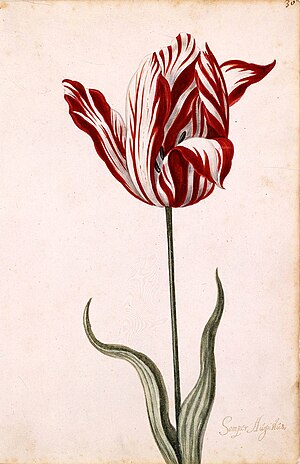

| Ever heard of Tulip Mania? It was the "original" bubble. (Photo credit: Wikipedia) |

- One million members have already joined!

- Join our family of ____________!

- (A membership counter steadily increases)

- 10000 users can't be wrong!

- and so on

However, I'll also show you a couple examples that conclusively proves that even if a TON of people have invested, it can still be bad for you. And they don't even have to be scams. They are known as "bubbles".

In a bubble, people see a few people enjoying success doing a particular thing, so they join in as well, which in turn entices MORE people to join in, driving up prices, which causes even MORE people to join in... and it snowballs until people realize this is stupid, gets out, and the snowball breaks apart, wiping out a lot of people.

And this is not even a scam, as it's completely legal, albeit stupid.

I picked four major cases: the tulip mania, the South Sea bubble (that gave us the term "bubble"), the Railroad Mania, and the Stock Market bubble that gave us the Great Depression.

Read more about "Why Following the Crowd is Stupid: How Speculation Bubbles Busted Fortunes, then and now.

No comments:

Post a Comment