First of all, there is no denying the wealth gap had been widened between the haves and have-nots during the pandemic. The people who barely got jobs are doing worse than ever. People who had wealth didn't give a **** other than being inconvenienced.

And currently, the Gamestop Short Squeeze is causing some panic among the most wealthy of investors... such as hedge fund managers, who wield tremendous wealth (of their clients) and can make or break companies. They can't believe a bunch of plebes had caused them to lose a ton of money.

To make a long story short: a "short-sell" is basically a "bet" that the price of a particular stock would fall. It's also known to "hold a short position". And a lot of hedge funds held a short position on GME (Gamestop) stock, tens of millions worth. On Tuesday, those hedge funds started to panic when GME stock starting moving the OTHER way instead... it's going up, and up. And the hedge fund managers decided to get out and just eat their losses. And when one does, others quickly followed, And their exit from their short position fueled the rise of the prices even higher, cause yet other short sellers to give in. All in all, it was estimated that this one stock caused its short sellers about 5 BILLION dollars net, and 876 million in a single day. And those who joined the buy-in early reaped tremendous benefits.

If you want detailed explanations, feel free to Google (tm) "short selling a stock" and "Gamestop short squeeze" and read genuine news sites offering analysis of this event, not just the pundits.

But what about the wealth gap?

This is where it becomes interesting. You see, people did engineer the "squeeze", but they have tried to rally the smaller investors for MONTHS, both on Reddit and on wallstreetbets Discord, and probably other venues as well. That they went viral was probably not what they expected.

But is this "market manipulation"? Or is this within the law, as no untruth was passed around, just a lot of fund managers caught with their pants down, and got... reamed in the process?

The fund managers are already speaking out... They want the government to stop "meme stocks" from destroying the market... which should probably say "their own portfolio's worth" instead. Some even as far as labeling wallstreetbets as "alt-right".

What's even more interesting is some brokerages have suspended the trade of these so-called "meme stocks" or placed severe restrictions on quantity. Though several later rescinded the limit, claiming that their trade clearinghouse had both technical and financial issues and once those are resolved the trading is back to normal. However, Robinhood so far has yet to relax the 1 share restriction, which is interesting in that Robinhood portrayed itself as an advocate for the small investors, thus the name.

There's a longer explanation here. Basically, the trading firms cannot execute the trade directly, but have to go through a clearinghouse. And because the clearinghouse is the one who has to actually execute the trade, they are the hold holding the most liability and risk, and that is worse for the most volatile stocks, and thus, the trading prices went up by a sharp margin, and somebody have to cover those costs, as they cannot be covered by customer funds, due to regulations. However, Webull and other platforms, but notably, NOT Robinhood, were able to get Apex to find other partners to cover its risks and trading resumed.

Indeed, other clearinghouses such as TD Ameritrade Clearing and Charles Schwab Clearing did not choose to restrict trading at all, and Apex only did so for limited time. Robinhood chose to restrict trading. It is worth pointing out however, Robinhood uses its own internal clearing, rather than using an external clearinghouse.

TL;DR -- Robinhood chose to restrict trading and has yet to relax. Other trading houses either never restricted trading, or was only restricted for a short time while some issues were settled.

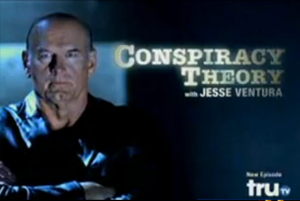

Is this merely coincidental timing? It certainly could be, and how Robinhood does business is indeed its own business, but the timing of the decision makes it the fodder of conspiracy theorists, calling Robinhood a "traitor" and "sellout" to the elite despite its namesake.

UPDATE: My explanation was haphazard. Apparently, a broker has to provide collateral of which the amount depends on the volatility of the stock to the clearinghouse. And Robinhood's CEO claimed he was woken up at 3AM that the company needs to put up like a billion bucks collateral IMMEDIATELY in subsequent interviews. On the other hand, he refused to admit he was put into a cash crunch by this. He chose to restrict trading, and thus, decrease the need for cash, and thus, there is no cash crunch.

But really, what Robinhood did was by a) by choosing to restrict trading instead of cash crunch, b) it had instead made itself conspiracy fodder through convenient timing.

I find Louis Rossmann's explanations on Youtube pretty digestible.

In a related case of "convenient timing", Discord is banning the wallstreetbets Discord server due to repeated inability to observe common netizen decency on profanity and bad language. Keep in mind that wallstreetbets Discord and the subreddit are populated by personalities who basically insult each other for kicks, that it became a style that just doesn't fit on Discord. The fact that Discord chose this particular moment to enforce the ban make wallstreetbets look like martyrs and Discord a stooge for the wealthy elite... which is rather (in)convenient timing indeed.

But the point is... Be skeptical, make sure what you hear are facts, not merely opinions. Opinions makes sense when they are presented because evidence presented are usually one-sided or out of context. Look up all the facts, both sides of the aisle, before making your decision.